Example

of Managua Real Estate Tax Bill

Example

of Managua Real Estate Tax Bill  Example

of Managua Real Estate Tax Bill

Example

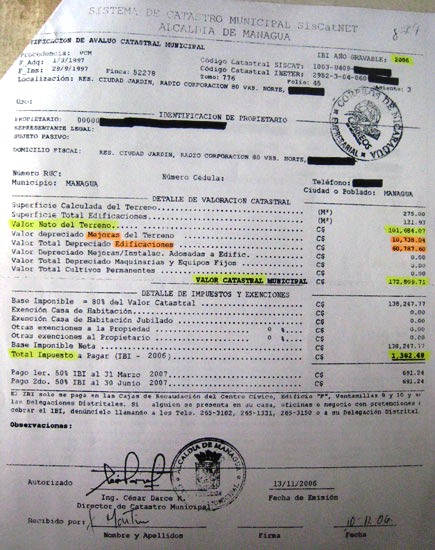

of Managua Real Estate Tax Bill  Example of a Managua real estate tax bill which shows the simplicity and advantage of a shift to the Land Value Tax system. Land value is highlighted in yellow and wealth values/improvements are highlighted in orange. The total tax ammount due is underlined in yellow. In this 2006 tax bill, an urban townhouse with a speculative selling price of US$60,000 and an actual rental income of US$4,800/year was oficially assessed at about US$9,500 and was taxed a total of US$76 for the year! The CEIHG's tax shift proposal is that the full non-speculative land value be captured by the state while improvements (wealth) need not be taxed. See article (in Spanish). |

Return to ![]() Main Menu . . . or . . . Propuesta IVT . . . or . . . October

2008 News-Noticias page

Main Menu . . . or . . . Propuesta IVT . . . or . . . October

2008 News-Noticias page

![]()

"Work with passion, save

the world!"

"Trabajar con pasión, salvar el mundo!"

since July 2011